By Jordan Meadows

Staff Writer

A retirement savings and readiness session hosted Wednesday afternoon by the NC Retirement Systems offered a detailed look at what it takes to prepare for life after work, reframing retirement as a matter of financial preparedness rather than a milestone tied to a specific age. The program, titled “Achieve Retirement Readiness,” walked participants through the primary sources of retirement income and the planning decisions that shape long-term security.

Presenters outlined how retirement income is typically built from multiple streams, including Social Security, pension benefits, and supplemental savings through 401(k) and 457 Plans. Participants were introduced to state-provided online planning tools that allow users to project future income, compare different retirement dates, and develop realistic budgets aligned with personal goals. Rather than offering a one-size-fits-all retirement age, the session emphasized envisioning what life in retirement will actually look like. Whether that future includes dividing time between multiple homes, maintaining an active social calendar, traveling, or enjoying a quieter routine at home, lifestyle choices directly affect how much income will be needed and for how long.

Participants were encouraged to plan for the possibility of living well into their 80s, 90s, or beyond, recognizing that retirement readiness means having enough income to support the desired lifestyle for the entirety of one’s life. While many people retire around age 65, others may do so earlier at 62 or even 57, and those who began saving aggressively at a young age may have the option to retire sooner.

Inflation emerged as a central theme in the discussion, with presenters illustrating how rising prices can steadily erode purchasing power over time. Since 1990, inflation has driven costs to roughly two and a half times their former levels, meaning that what $100 bought in 1990 now requires about $248. A practical example showed how a $1.50 loaf of bread in 2012 could cost nearly $4 by 2040. The implication for retirement planning was clear: savings that are not invested in a way that keeps pace with inflation risk losing value, potentially forcing retirees to scale back their standard of living as costs rise.

The session also addressed how much income retirees may need to replace. Financial guidance often suggests aiming for 70% to 90% of pre-retirement income, though presenters stressed that the appropriate target depends on individual situations. Participants were encouraged to consider whether they could meet their expenses without a regular paycheck, how their spending might change in retirement, whether their mortgage would be paid off, how health care costs would be managed, and whether they planned to continue working or generating income. Decisions about where to live and how to spend time in retirement were framed as financial considerations as much as personal ones.

For 2025, state employees can contribute up to $23,500 annually to each plan. Additional catch-up options are available, including an extra $7,500 per plan for individuals aged 50 and older, and a “super catch-up” contribution of up to $11,250 per plan for those between ages 60 and 63. Presenters noted that these provisions can significantly boost retirement income, especially for those who began saving later in their careers.

Social Security was explained in detail as another cornerstone of retirement income. Benefits can begin as early as age 62, but doing so permanently reduces monthly payments. Conversely, delaying benefits increases them by approximately 8% for each year waited, up to age 70. An example showed how a monthly benefit of $1,023 at age 62 could grow to $2,000 by age 70, nearly doubling, with the potential to add tens of thousands of dollars in lifetime benefits for someone who lives into their mid-80s.

The session also clarified federal rules surrounding required minimum distributions, or RMDs, which apply to pre-tax retirement accounts once individuals reach a certain age and are no longer working for their employer. Depending on an individual’s date of birth, RMDs may begin at age 70 and a half, 72, or 73, with a specific deadline known as the required beginning date. Understanding these rules, presenters noted, is critical to avoiding penalties and managing withdrawals in a tax-efficient manner.

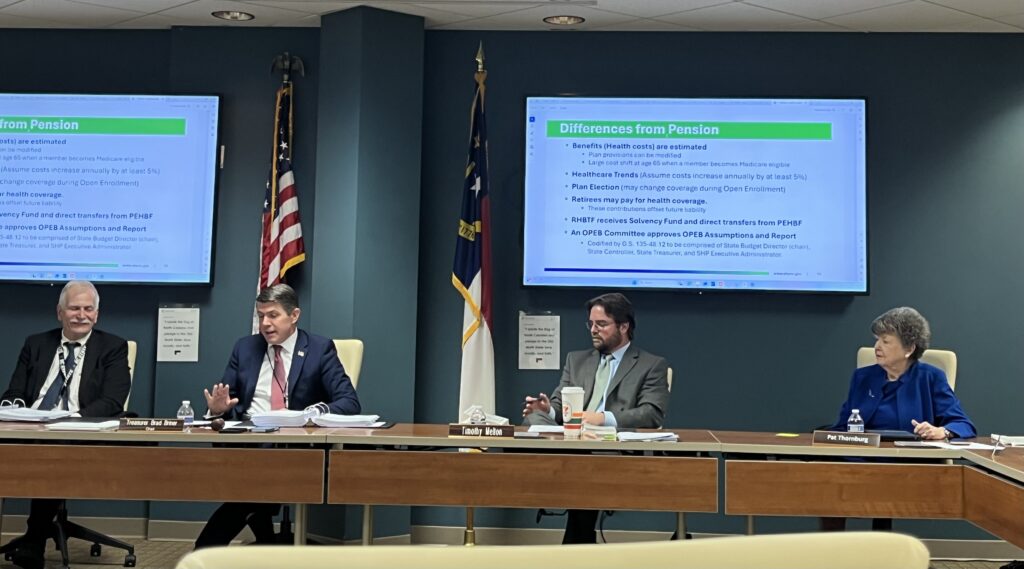

The discussion on retirement readiness unfolded as state leaders signaled potential changes that could directly affect retirees already drawing benefits. State Treasurer Brad Briner told legislators at the end of last year that improved performance of the state’s pension investments could open the door to long-awaited cost-of-living adjustments for retired state employees, linking stronger returns to the possibility of increased monthly benefits.

During a legislative oversight hearing in October, Briner acknowledged that the pension system has struggled to meet its own investment expectations. He noted that the state has projected a 6.5% rate of return but has consistently fallen short, placing North Carolina near the bottom nationally for pension investment performance.

Those changes are set to begin this month, when control of pension investments will shift to a newly created body, the N.C. Investment Authority.